Rates revival

Massive move higher in rates. Note we are above the 100 and the 200 day again...

NASDAQ vs rates

The gap between NASDAQ and the US 10 year (inverted) is getting very wide.

Precious puke

Gold's down candle is massive. The shiny metal is crushing the 50 day. A close below $2300 and this risks accelerating to the downside. 100 day down at $2200.

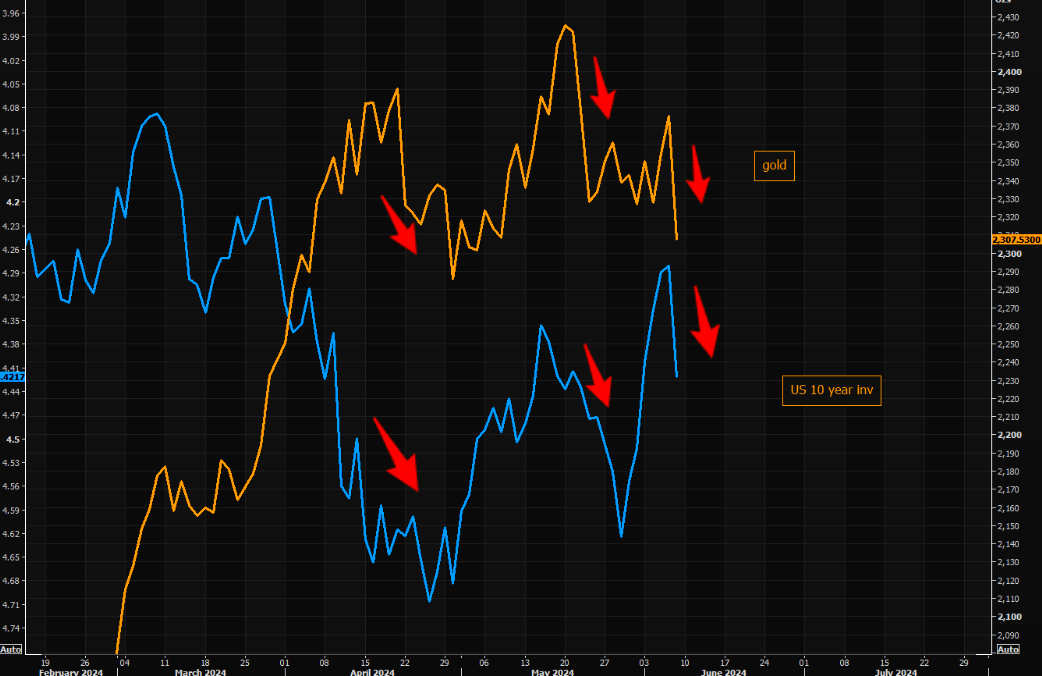

Gold and rates

Gold has actually been sensitive to bigger moves higher in the 10 year over the past months.

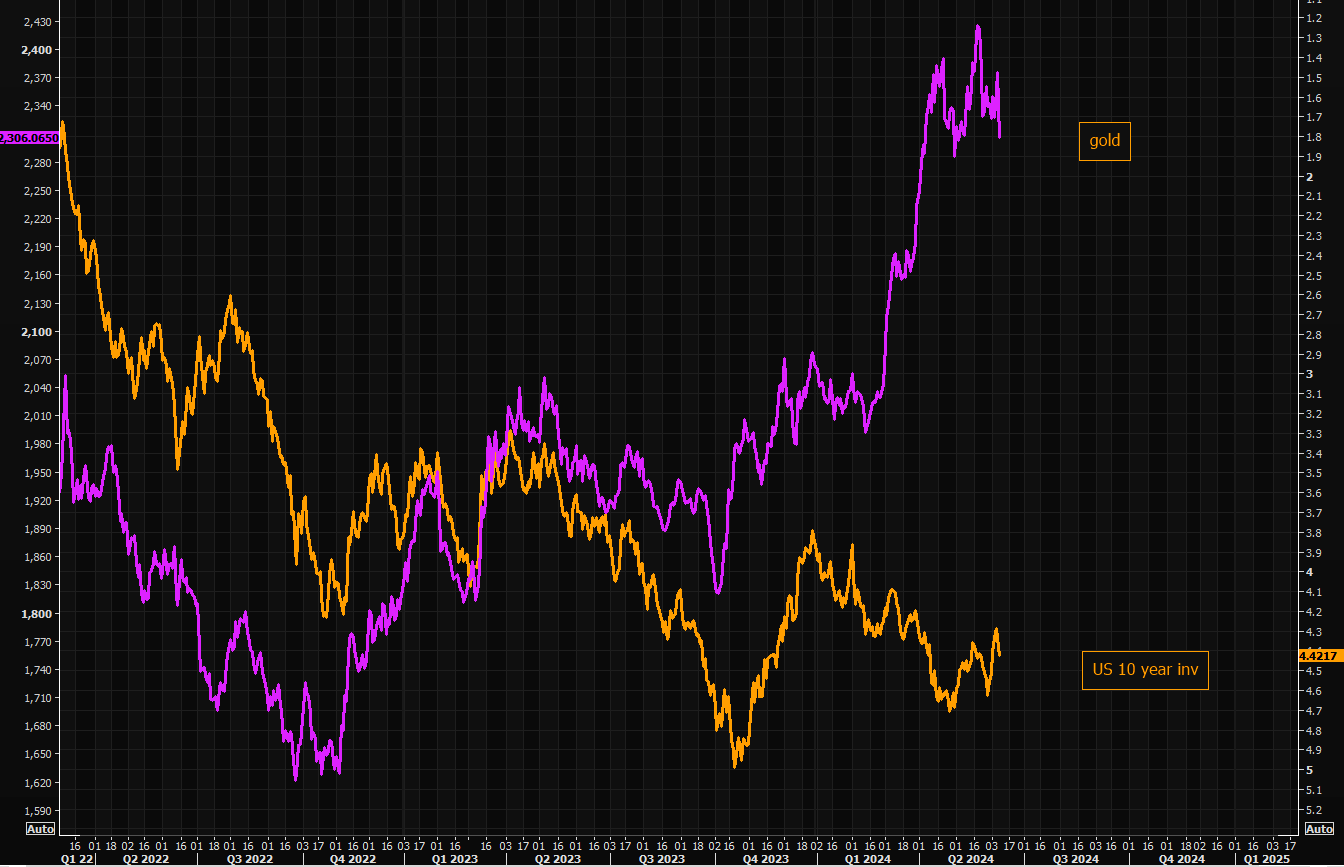

and the longer term

A snapshot of the longer term gap between gold and the US 10 year (inverted).

Copper puking

We outlined our copper correction view a few weeks ago (here). The metal has imploded since then and is crushing the 50 day today. We are approaching some support levels, but we wouldn't be surprised to see the "copper bubble" implode further and reach the 100 day.

CTAs forced sellers

CTAs pushed momentum during the melt up in metals. This has now become a must sell position. We outlined the big downside convexity on Tuesday. Just a gentle reminder chart.

Bitcoin - mean reversion mania

Bitcoin's great range continues to hold. Pushing momentum breakouts continues to be a costly strategy.

The gap

SPX vs Fed reserves gap just got even wider....

Size long gamma

Dealers are running the second biggest long gamma ever, suppressing volatilities. Goldman's trader Garrett writes: "with ~$9.5 billion of gamma to trade per 100bps; dealers have to sell 35,000 eminis on a 1% rally, and buy 35,000 eminis on a 1% sell off". 5350 is basically a massive pin strike that will suppress moves around it. Options related risks change with time, so the increase in gamma, isn't necessarily only driven by recent flow by end customers. One thing is sure, the delta flow from dealers is "real" flow that will be hedged in the market. For the 1 minute explanation on gamma, see here.