NVDA: Probably nothing...

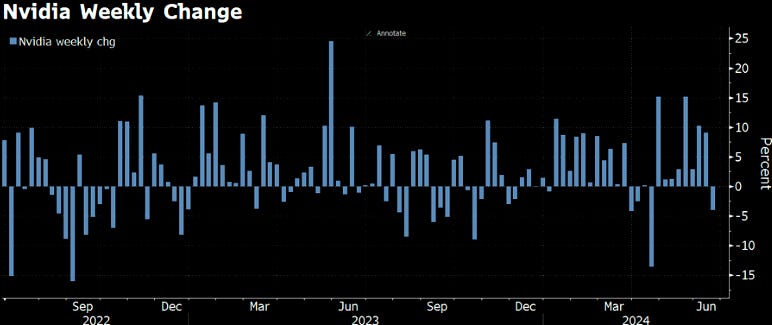

First negative week for Nvidia since April. Only short consolidation or trend reversal?

Probably nothing (II)

Insider selling in NVDA is at the fastest pace in years.

NVDA YOLO

Some serious daily retail inflow into NVDA

Already?

People seem to be buying the NVDA dip. The stock is putting in some sort of a hammer like candle in the lower part of the "imperfect" trend channel. Note the 21 day is down around 120.

Semis 100%-tile

From a global perspective, Semis L/S ratio (among just HFs) is back near 10 year highs and net exposure is back up to the top of the trend again.

Semis could be flat / weaker from here

"...our combined metric (hfs, etfs, retail) of flows & positioning in us semis has jumped back to peaks from which semis have often been flat / weaker"

Biggest increase in P/S

Here are the stocks in the large-cap Russell 1,000 that have seen the biggest increase in their price to sales (P/S) ratios since the current bull market began on 10/12/22. As shown, NVIDIA (NVDA) has seen its share price rise more than 1,000% during this bull market, but its P/S ratio has made 32 turns higher from 9.7x up to 41.9x! That's by far the biggest jump of any stock in the index. Of the 30 stocks shown, the average P/S ratio has risen 9.6 points from 8.6x up to 18.2x, and most stocks on the list are Tech stocks.